RON

HOLCOMB

Last month, we examined Tipmont’s reliability and found that 2015 was one of Tipmont’s most reliable years to date, reducing our outages by 41 percent from 2014.

A big part of that success stems from significant investment in infrastructure upgrades and our tree-trimming program, which we moved from a six-year to a three-year cycle. We faced a snowstorm on Feb. 24 that caused outages across the Midwest as wet, heavy snow brought trees into contact with power lines. Tipmont never had more than 300 members out at one time, thanks to our commitment to continuous upgrades and improvements. Investments like these are possible in part because of access to low-cost capital and a smart borrowing strategy.

Why we borrow

Utilities have two primary sources of cash to grow, operate and maintain the system: the rates members pay for service and the money we borrow. Borrowing is necessary to help maintain stable rates. It also helps avoid generational cost-shifting, or recovering the cost of an asset well before its depreciated life ends.

For example, Tipmont periodically needs to add a substation to support growth or replace an aging substation. Substations last about 40 years and cost up to $3 million to construct. Borrowing the necessary funds to construct the substation and then paying that cost back incrementally over its life ensures that future members who benefit from the service it provides also contribute to recovering the cost.

Sources of funds and how Tipmont compares

Low interest loans from the federal government and the National Rural Utilities Cooperative Finance Corporation (CFC) are available to electric cooperatives to keep interest costs in check, which in turn keeps your rates affordable.

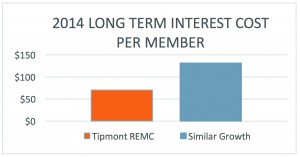

Tipmont’s median long-term interest cost per consumer is 30 percent less as compared to all U.S. electric cooperatives in 2014, the latest year that data are available.

An even better comparison is one with cooperatives enjoying the same strong growth as Tipmont. In this category, Tipmont’s interest rates per member are nearly 50 percent lower than the median. (See chart below.)

Why we’re good at it

So, how do we achieve this? Here are a few of the key steps we take:

- Leveraging Tipmont’s eligibility to borrow from the federal Rural Utilities Service (RUS), which offers the most attractive rates in the market.

- By taking advantage of low interest rates and refinancing existing loans with a higher interest rate. Our finance team monitors interest rates constantly with the goal of locking in the lowest possible rate.

- Reducing risk by making sure our loan portfolio has diversified maturity dates capturing a range of interest rate market conditions over time. Additionally, staggering the borrowing helps us manage our cash flow by only drawing on a portion of the loan as needed to pay for construction costs.

The full cycle

Next month, we’ll look at Tipmont’s performance related to operating efficiencies and how those lead to a better value for your investment in Tipmont as a member. I’d welcome any feedback or questions you might have. Email me at ceo@tipmont.org and share your thoughts on how we can continue to move Tipmont forward together.

RON HOLCOMB is CEO of Tipmont REMC.