DC REMC Project Manager

Capital Credits. We often hear this term but don’t always understand what they are or how they work. For us at Decatur County REMC, capital credits are part of our core principles and another reason we are different from other electric providers.

In simple terms, capital credits are the margin left over after doing business. This is not money we keep, but rather money we return to you, the member.

Determining the amount of your capital credits is completed through a process called allocation. Decatur County REMC relies on revenue from monthly bills to cover expenses and maintain our plant. After the cost of running and improving the business is complete, the margin left over is credited to each member as a capital credit allocation and is based on the revenue you paid each year.

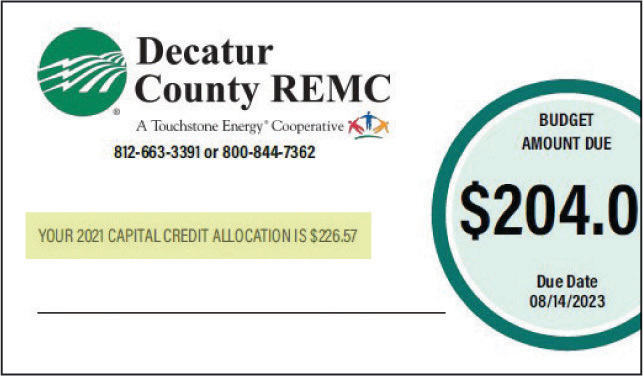

During this yearly process, we notify each member what their allocation amount will be. The notice is printed on your billing statement. You will notice it on your bill this month, in the upper left-hand corner. The message will read: YOUR 2021 CAPITAL CREDIT ALLOCATION IS $XX.XX. This means that after the 2021 books were closed and audited, Decatur County REMC has allocated (recorded) that amount of money to your account to be paid back in the future.

You will also see this notice on your October bill for your 2022 capital credits allocation. Having this back-to-back is a special circumstance this year due to the Decatur County REMC Board of Directors choosing to change the fiscal year from June 1-May 31 to Jan. 1-Dec. 31. In the future, you will see this listed once a year on your billing statement.

Members get paid their capital credits through a process called retirement. The Decatur County REMC Board of Directors looks at the financial needs of the cooperative and determines when the co-op is financially able to retire those funds. The board will retire specific year(s), or even a certain percentage from multiple years. Current members will see this reflected on their billing statement as a credit, while previous members will be mailed a check.

Your capital credit balance is not a cash value and is not able to be given out at any time; it is an amount received as approved by the board. All allocated money will be paid back to the member, even if it is to a member’s heir(s). Decatur County REMC is currently retiring on a 25-30-year cycle.

Since the first capital credit retirements were made in 1968, $15,391,000 has been returned to our members. This is what sets co-ops apart, and that is the cooperative difference.

If you have any questions about how capital credits work, do not hesitate to give me a call.